Manufacturing Asset Monetization: What It Is and How It's Done

For many manufacturers, idle machinery and surplus equipment quietly drain resources. They lock up capital, occupy valuable space, and continue to depreciate without adding value. Left unmanaged, these assets generate hidden costs that erode efficiency and profitability.

That’s why finding ways to convert underutilized equipment into measurable value has become so important. Companies that treat asset monetization as a structured process can improve cash flow, reduce waste, and keep their operations lean.

This article will explain what manufacturing asset monetization is, outline the main methods companies use, and walk through the process step by step.

What Is Manufacturing Asset Monetization?

Manufacturing asset monetization, as a key part of manufacturing asset management, is the process of extracting financial value from underutilized or idle manufacturing assets such as machinery, equipment, and facilities. The goal is to turn these resources into revenue or liquidity, improving capital efficiency and supporting long-term sustainability.

Traditionally, manufacturers kept excess equipment as a safeguard. This was common for MRO equipment and other critical assets that kept operations running smoothly. While the approach reduced immediate risk, it also created problems when applied to non-critical or idle equipment. Unused assets drove up storage costs, lost value through faster depreciation, and tied up capital that could be used elsewhere.

Monetization changes this mindset.

This approach addresses challenges like excess capacity from market shifts or technology upgrades, transforming potential burdens into opportunities for value creation. By freeing up capital tied to non-productive assets, manufacturers can reinvest in innovation, expansion, or debt reduction.

At its core, asset monetization reflects a shift from holding assets passively to managing them actively for measurable financial returns.

Why Manufacturing Asset Monetization Matters

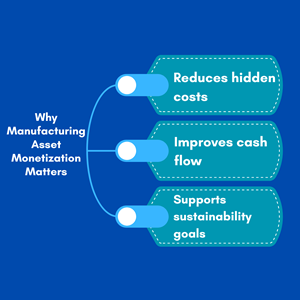

For manufacturers, holding on to surplus or idle equipment often works against operational and financial goals. Monetization addresses this by delivering value in three key ways:

-

Reduces hidden costs

Idle assets continue to consume space, require upkeep, and lose value through depreciation. Monetizing them removes these ongoing costs.

Improves cash flow

Selling unused equipment frees up capital that can be redirected toward production, innovation, or strategic investments.

Supports sustainability goals

Monetization through reselling equipment supports industrial circularity, lowers waste, and ensures compliance with environmental standards.

How Manufacturing Asset Monetization Is Done

There are numerous ways to monetize manufacturing assets, each with a different process

Liquidation Auction

Liquidation auctions are one of the fastest ways to convert surplus assets into cash. Instead of negotiating with individual buyers, manufacturers can sell equipment through competitive bidding, which often drives prices closer to true market value.

This channel works particularly well when companies need to move a large volume of assets quickly, such as during facility closures, mergers, or major equipment upgrades.

The auction format creates urgency among buyers, helping sellers achieve faster turnaround compared to traditional resale.

The value of liquidation auctions lies in speed, transparency, and reduced carrying costs.

Key Steps:

- Identify surplus equipment suitable for auction (often large volumes from closures or upgrades).

- Prepare items for sale with basic cleaning and documentation.

- List equipment on a liquidation platform or arrange an on-site/timed event.

- Run the auction, allowing multiple buyers to bid competitively.

Note: Companies that don’t have the capability or capacity to run auctions in-house can work with liquidation auctioneers for smooth, fast processes to maximize the total ROI of the project.

Asset Recovery Specialists

Asset recovery specialists bring expertise and structure to the monetization process. They begin by auditing a manufacturer’s idle assets, assessing market value, and identifying the best channels for resale or disposal. This professional evaluation helps avoid undervaluing equipment.

Specialists also manage the practical side of recovery, from compliance to marketing and logistics. Their established networks of buyers and brokers ensure assets are matched with the right market, increasing the chances of achieving stronger returns.

The value of working with asset recovery specialists comes from higher recovery rates, faster sales, and reduced internal workload.

Key Steps:

- Conducting an audit of surplus and idle assets across facilities.

- Appraisals and valuation of equipment to determine fair market value.

- Selecting monetization channels through the specialist’s network.

- Coordinating logistics, dismantling, and compliance requirements.

- Creating a report on the recovery results.

Parts Harvesting

Parts harvesting is a practical way to recover value from equipment that can no longer be used as a whole. Instead of scrapping the machine entirely, you can salvage components that are still in good condition.

Recovered parts can be sold into secondary markets where demand exists for older or hard-to-find parts directly or through a broker.

By extending the usefulness of individual components, parts harvesting turns non-productive equipment into a source of ongoing value.

The downside of parts harvesting is that you’re then left with unusable, unsellable assets that still take up valuable floor space. They’ll have to be scrapped for recoverable metals at the earliest possible convenience to maintain smooth operations.

Key Steps:

- Identify end-of-life equipment that still contains usable components.

- Safely disassemble machinery to extract viable parts.

- Test and catalog components for quality and compatibility.

- Reuse parts internally in maintenance programs or sell externally as spares.

- Dispose of remaining scrap through recycling or certified disposal.

Vendor Trade-In and Buy-Back Programs

Many original equipment manufacturers (OEMs) offer trade-in or buy-back options for older machines. Through these programs, companies can exchange outdated equipment for credit or direct payment when purchasing new models.

This approach reduces the hassle of managing disposal, since the OEM takes responsibility for removal and compliance. At the same time, it lowers the overall cost of upgrades and ensures that some value is recovered from machinery that would otherwise sit idle.

Note: Vendor programs work best when manufacturers are already committed to the same brand or product line, making them a straightforward channel for asset monetization.

Key Steps:

- Contact the OEM to confirm eligibility for trade-in or buy-back.

- Provide details and documentation of equipment condition.

- Receive a valuation and credit offer from the OEM.

- Arrange equipment removal — typically managed by the vendor.

- Apply credit or payment toward the purchase of new equipment.

A Quick Start Checklist for Manufacturing Asset Monetization

Identify Idle and Underutilized Assets

To start asset monetization, one must know exactly what equipment is no longer creating value. Many manufacturers have machines sitting in storage, duplicates across facilities, or older models that are underused on the shop floor.

Without visibility, these assets quietly depreciate and continue to add costs.

A structured audit, supported by asset management tools, helps flag which equipment should be considered for resale, recovery, or other monetization channels. This step lays the foundation for capturing value instead of letting capital sit idle.

Look for Redistribution Opportunities Before Asset Monetization

Not every asset has to be sold to create value.

Sometimes, underutilized machinery can be redeployed internally to another facility where it is needed.

While this does not generate direct cash, it delivers savings by reducing capital spending and extending the useful life of existing equipment. In many cases, this makes it a faster way to capture value than selling on the open market.

Decommissioning

Before equipment can be sold or recycled, it often needs to be decommissioned, disconnected, dismantled, and prepared for transport.

This step can involve labor, safety procedures, and logistics, so it’s important to clarify responsibilities in advance.

In most transactions, the buyer covers the cost of decommissioning, but expectations should always be outlined clearly in the agreement.

Having this sorted early prevents disputes, speeds up the sale, and ensures the monetization process stays on track.

Track Results

The final step in asset monetization is measuring outcomes.

Tracking what was recovered from each channel, resale, asset recovery programs, parts harvesting, vendor trade-ins, and recycling, provides a clear picture of performance.

By comparing recovery rates, manufacturers can see which methods deliver the strongest returns and where adjustments are needed.

This insight helps refine future decisions, ensuring that each round of monetization creates greater value and avoids wasted effort.

Governance & Compliance

Codify ownership, approvals, and audit trails for every monetization event. Ensure EHS and regulatory controls are met, decontamination, fluid/drug/hazmat handling, export controls, data wipes on CNC/PLC/HMI, and software license transfers, backed by chain-of-custody records and certificates of recycling/destruction.

Standardized “as-is” terms, liability boundaries, and decommissioning scope reduce risk, prevent value leakage, and speed time-to-cash.

Final Thoughts

Idle and underutilized assets quietly erode margins; treating monetization as a disciplined, repeatable workflow turns them into liquidity and leaner operations. The outcome is better cash flow, lower carrying costs, and measurable progress on circularity.

Choose channels by objective and asset condition: redeploy where it offsets capex, then move remaining equipment through auctions for speed, specialists for higher recovery, OEM trade-ins for frictionless upgrades, and parts harvesting for legacy value, underpinned by clear decommissioning scope.

Make it continuous, not episodic: run regular audits, track recovery rate, time-to-cash, and carrying-cost avoided, and feed those learnings into the next wave. That shift from passive holding to active value creation, compounds returns over time.

Institutionalize the practice with a cross-functional owner, standard playbooks, and digital asset registers tied to market benchmarks. Build supplier panels and pre-approved contracts to accelerate disposition.

Integrate EHS and compliance gates. Socialize KPI dashboards so leaders see recovered value monthly, keeping momentum high and preventing idle inventories from re-accumulating. Systemically.

Luke Crihfield is Director of Demand Gen at Amplio, helping manufacturers turn surplus into opportunity through AI-driven growth.

Featured Product