AM Research Publishes In-Depth Market Study on Additive Manufacturing for Military and Defense; Estimates $0.3B in Direct DoD Spend in 2023, Growing to $1.8B in 2032

In a groundbreaking analysis conducted by Additive Manufacturing Research (formerly SmarTech Analysis), the market study titled "Additive Manufacturing for Military and Defense" reveals significant opportunities and potential for 3D printing in the military and defense sectors, and compelling insights into the transformative role of additive manufacturing within these critical sectors. The comprehensive study sheds light on the rapid evolution and potential impact of additive manufacturing technologies on the defense and military landscape.

The study's findings hold significant implications for defense contractors, technology providers, investors and policymakers, indicating the need for proactive measures to harness the full potential of additive manufacturing in addressing the ever-evolving national security landscape. As the world moves towards an era defined by escalating and evolving global tension and security challenges, the integration of additive manufacturing is poised to make its mark on the way defense and military entities conceptualize, develop, and deploy critical assets and equipment.

"Additive Manufacturing for Military and Defense" focuses on the United States' military and defense initiatives to incorporate and leverage 3D printing into its operations. Incisive analysis is provided based on expert and first-person interviews within the US Navy, US Air Force and Space Force, and the US Army, and offers recommendations for additive manufacturing vendors seeking to sell into the military and defense sector.

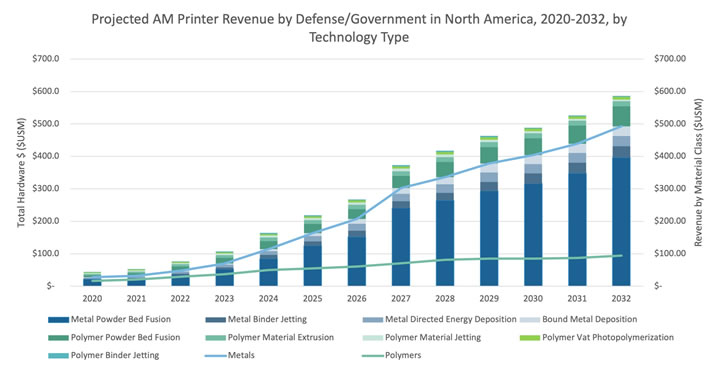

The report considers the United States Department of Defense 2024 budget and features an Excel-based market sizing and forecasting for all leading types of 3D printing, including Powder Bed Fusion, Directed Energy Deposition, Metal Binder Jetting and Bound Metal Deposition. The report considers revenues derived from hardware, materials and printing services for both the polymer and metal additive manufacturing markets.

Companies and organizations mentioned or profiled include but are not limited to: 3D Systems, SPEE3D, Markforged, Lockheed Martin, Fortify3D, Boeing, Raytheon, ASTRO America, Additive Manufacturing Coalition, General Dynamics, America Makes, GE Aerospace, Xerion, Nanoe, BASF, and more.

This AM Research report is co-authored by Tali Rosman and Matt Kremenetsky. Tali Rosman is a deeply experienced 3D printing industry executive most recently having built and launched XEROX's ElemX Additive division (now part of Additec) where she oversaw the first ever 3D printer installed on a US Navy ship. Prior to XEROX, Rosman held senior roles at Stratasys, one of the two largest 3D printing companies in the world. Matt Kremenetsky is the Macro Analyst for 3DPrint.com, the most significant online news source in the 3D printing industry. Kremenetsky also serves as an analyst for AM Research.

For more information on the report, including a free sample, please visit: https://additivemanufacturingresearch.com/reports/additive-manufacturing-for-military-and-defense-market-analysis-and-forecast/

About Additive Manufacturing Research:

Since 2013, Additive Manufacturing Research (formerly SmarTech Analysis) has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. AMR's analysis and data drives strategy development in the additive industry and has been adopted and presented by many of the industry's largest firms.

For more details on our company: http://www.additivemanufacturingresearch.com/

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product